County board addresses cannabis issues

News | Published on October 31, 2023 at 3:00pm EDT | Author: henningmaster

0OTC board approves Hwy. 35 Dent to Vergas design

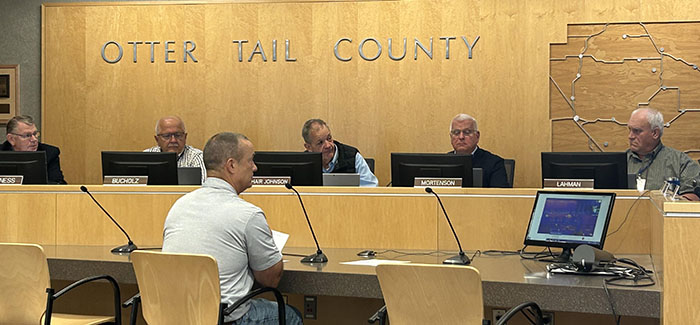

Assistant County Land and Resource Management Director Kyle Westergard was among those addressing the Otter Tail County Board of Commissioners on Tuesday, Oct. 24. In back, from left, are Commissioners Lee Rogness of Fergus Falls, Dan Bucholz of Perham, Wayne Johnson of Pelican Rapids, Kurt Mortenson of rural Underwood and Bob Lahman of Parkers Prairie.

By Robert Williams

Editor

County Engineer Krysten Foster updated the Otter Tail Board of Commissioners on the design plans for County State-Aid Highway (CSAH) 35 between Dent and Vergas Tuesday, Oct. 24, at the Government Services Center in Fergus Falls.

“We moved forward with the wetland delineation under a separate contract earlier this fall and we’re hoping to complete permitting, as well as any necessary right-of-way acquisition, in 2024 and are set to start construction in 2025.

The board approved a proposal of $316,600 from Moore Engineering for all engineering services.

Foster also noted Moore’s acquisition of Wadena County Highway Engineer Ryan Odden to their team.

“Looking forward to having a new, local contact in our area for this project,” said Foster. “The goal here is to widen the shoulders to provide better walking options and more space on the north end of the project in particular, which is why we’re looking for external assistance rather than in-house services for this type of a project.”

Right-of-way acquisition is not included in this job and the county will be doing the signage work on the project.

In other county road projects, a Burlington Northern railway crossing surface installation agreement was approved on CSAH 75 near Wadena. The scheduled 2024 project was moved up to this week by request of the railroad, given that fiscal year 2024 has already begun, according to Foster.

Cannabis ordinance

The board finalized the ordinance regulating the use of cannabis and cannabis derived products in public places. The ordinance has been adopted by multiple towns and townships throughout the county.

“Cities and townships were pretty supportive,” said Public Health Director Jody Lien.

In September, Sheriff Barry Fitzgibbons and County Attorney Michelle Eldien encouraged towns to adopt the county ordinance as law enforcement will be enforcing the county ordinance not differing city ordinances.

Fitzgibbons highlighted Vergas as an example of a town that should use the county ordinance due to having no city-based law enforcement officers.

Vergas adopted the county’s ordinance at the city council meeting in September. The ordinance basically restricts public use to a private residence, a private property, not generally accessible by the public, or on the premises of an establishment or event licensed to permit on-site consumption.

Tax abatements

The county approved tax abatements on a portion of the county’s share of property taxes on 18 different properties in the amount of $10,000 for a term of up to five (5) years to finance a portion of the costs of the project.

The list included one property in Amor Township, one in Edna Township, several between Perham and Ottertail and four in the New York Mills area.

A public meeting was held last council meeting to consider applications for the single-family tax rebate program that were approved Tuesday.

Perham TIF modification

The City of Perham notified the commissioners of a plan to modify Tax Increment Financing (TIF) Districts in Development District No. 2, which includes the Bongards expansion.

Currently under consideration for the district is a proposal to facilitate the company’s permeate dryer/milk intake expansion in the city. The city has determined that it will be necessary to provide assistance to the project(s) for certain district costs.

The city has studied the feasibility of the development or redevelopment of property in and around the district. To facilitate the establishment and development or redevelopment of the district, this TIF Plan authorizes the use of tax increment financing to pay for the cost of certain eligible expenses. The estimate of public costs and uses of funds associated with the district are:

• Site Improvements/Preparation $650,000

• Utilities $125,000

• Other Qualifying Improvements $24,985

• Administrative Costs (up to 10%) $117,592

Total project costs $917,577

Interest $375,934

Total $1,293,511